Kuala Lumpur, 24 March 2025 — A groundbreaking study conducted by 60 Decibels in collaboration with the International Labour Organization (ILO), a United Nations agency, has revealed the significant benefits of Earned Wage Access (EWA) on financial well-being. The study found that 80% of Paywatch users reported an improved quality of life, underscoring the potential of responsible EWA solutions to enhance financial resilience and workplace satisfaction.

Key findings from the study include:

- 57% of employees experienced reduced financial stress.

- 51% gained better control over their finances.

- 49% decreased their reliance on payday loans or salary advances.

- 36% increased their savings.

- 30% reduced household debt.

The study also highlighted the positive impact of Paywatch’s EWA service from an HR perspective. Notably, 41% of users reported improved relationships with their employers, and 46% stated they would prioritize job opportunities offering EWA services in the future.

The rapid adoption of EWA in emerging markets has sparked discussions on its role in promoting economic inclusion and workforce well-being. The study suggests that responsible EWA models, such as Paywatch, empower workers to manage their financial health effectively without falling into debt traps.

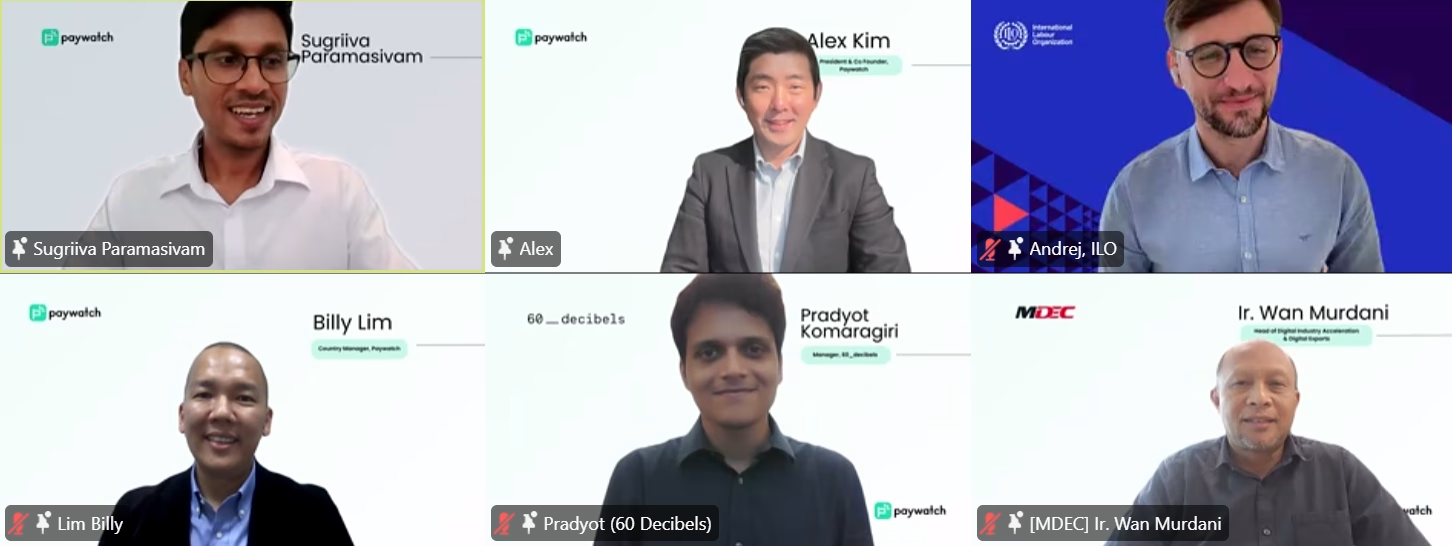

The findings were presented during a media briefing on 24 March 2025, hosted by Ir. Wan Murdani bin Wan Mohamad, Head of Digital Industry Acceleration & Digital Exports at the Malaysia Digital Economy Corporation (MDEC). The event featured a panel discussion titled “EWA in Action — From Global Study to Workforce Transformation in Southeast Asia,” with insights from Alex Kim, President and Co-Founder of Paywatch; Billy Lim, Country Manager, Paywatch; Andrej Slivnik, Technical Officer at the ILO Global Centre on Digital Wages for Decent Work; and Pradyot Komaragiri, Manager at 60 Decibels.

Alex Kim commented, “Paywatch is transforming how workers access their wages, bridging financial gaps while promoting responsible financial habits. This study confirms what we’ve observed: when implemented responsibly, EWA is a game-changer for both workers and employers. For workers, EWA is becoming a key factor in job decisions, while for employers, it enhances workplace offerings and demonstrates a commitment to employee well-being.”

Andrej Slivnik emphasized the broader implications of the study: “Financial inclusion is not just about technology; it’s about dignity. This research shows how digital wages and the financial services they enable can improve workers’ financial well-being. By providing timely access to wages, EWA helps workers manage their financial needs more effectively. Moving forward, it is essential to consider the risks and ensure the responsible implementation of EWA models. We look forward to collaborating with providers, regulators, and workers’ organizations to develop policies that protect and empower workers globally.”

Pradyot Komaragiri, who led the data collection and analysis, added, “Our findings demonstrate the value of responsible EWA solutions in improving workers’ financial health. The data consistently shows that ethical and transparent EWA implementation can reduce financial stress, enhance workplace relationships, and promote economic inclusion. This addresses many of the financial challenges workers face today, proving that early access to wages can significantly impact their financial well-being.”

Beyond wage access, Paywatch offers additional financial tools to support long-term stability. Its ESG-aligned platform includes a zero-fee Bill Payment service and a new insurance policy with no installment fees, ensuring essential protection without financial strain. These innovations reflect Paywatch’s commitment to providing fair, transparent, and sustainable financial solutions. As Malaysia faces rising living costs and financial pressures, responsible financial services like EWA are becoming essential tools for economic stability.

Paywatch is dedicated to collaborating with global organizations and regulators to promote responsible financial access, ensuring fair and transparent wage practices that prevent workers from falling into debt traps. As part of this effort, discussions are underway to establish a Conduct of Practice, setting global standards for responsible EWA services. This initiative aims to guide the EWA movement in the right direction and distinguish fintechs that are genuinely impact-driven worldwide.

[About Paywatch]

Backed by major financial institutions, Paywatch is a leading Earned Wage Access service provider committed to holistic financial wellness. Partnering with top enterprises and banks across Southeast Asia, Paywatch enables employees to achieve brighter financial futures through secure and flexible financial accessibility. Our mission is to empower people to live better lives.

Paywatch is the most well-funded, Shariah-compliant, and ESG-focused EWA service provider in Southeast Asia, leading the market by transaction volume, number of client companies, and territorial coverage. Operating in Malaysia, South Korea, the Philippines, and Indonesia, Paywatch has received global recognition for its dedication to fair financial access, including being named on the Forbes Asia Top 100 to Watch list.

Interested in reading the latest news? Click here for more!